TAMPA, Fla. -- Thousands of Americans become victims of rental scams every year. You can avoid them by recognizing the most common fraud schemes and being proactive when searching for a new place to live.

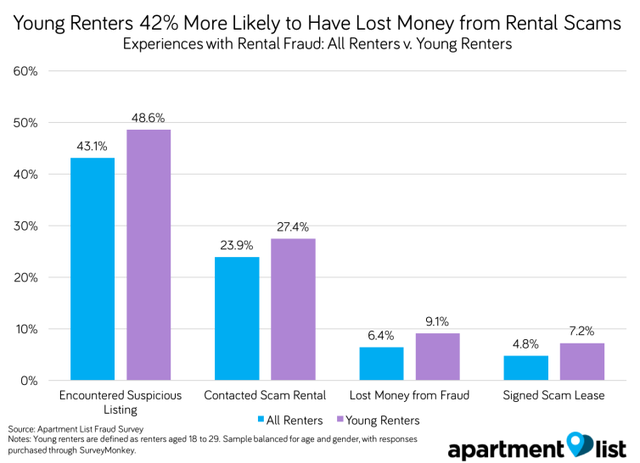

According to ApartmentList.com, around 5.2 million U.S. renters have lost money in a rental scam. One in three victims report losing over $1,000 after paying a security deposit or rent on a fraudulently-advertised property.

The top five most common scams are:

- Bait-and Switch: Where a scammer tries to get you to sign a lease or collect a deposit for a different property than one advertised.

- Phantom Rentals: A crook advertisers for a place that does not exist or is not for rent.

- Hijacked Ads: A fake landlord posts an ad for a real property with altered contact information. Many times, these are for properties for sale or in foreclosure.

- Missing Amenities: A landlord places an advertisement for a real property listing amenities it does not have to collect a higher rent.

- Already Leased: A landlord uses an ad to collect security deposits or application fees for properties already leased.

In the Tampa Bay area, ApartmentList.com says 21.7% of renters encountered a fraudulent listing and 6.5% of people lost money. People encountered the most fraudulent ads in San Francisco, Los Angeles, Cincinnati, Sacramento, Phoenix and San Diego.

Fake listings can be difficult to spot but there are a few warning signs to look for.

RELATED: Local beach rental companies warn about rental property scam

Listings lacking either an address or photos are more likely to be fake. Using Google Street View can help identify if the property exists if a landlord lists an address and posts photos.

To attract more interest, scammers will often list properties for rent at prices well below the going rate in the same neighborhood or advertise there is no screening process.

ApartmentList.com says you should take the following seven steps to avoid losing money:

- Visit the property in person to confirm the apartment matches an advertised listing.

- Verify the landlord owns the property by looking up city records or talking to the building's manager.

- Speak to current tenant to confirm information the landlord gave you.

- Rent from a property management company that employs trusted leasing agents

- Never pay with cash or a wire transfer because these forms of payment are impossible to track.

- Avoid becoming a victim of identity theft by handing over confidential information like a Social Security number until you know the property is legitimate.

- Confirm the price and any amenities are included in the rent in writing before signing a lease.

You can still become a victim of rental fraud by following these steps. If you believe you are a victim, you can file a report with your local law enforcement agency. Also make sure to contact your state's consumer protection agency for assistance.